The Intergovernmental Panel on Climate Change (IPCC) recently released the final synthesis report of its Sixth Assessment Report (completed every 5 years). This report stated that carbon dioxide levels in the atmosphere are higher now than they have been in the last two million years. Additionally, global greenhouse gas emissions between 2010 and 2019 were higher than any previous decade in human history. But the report also documented that our society has the tools we need to turn it around. Clean energy technologies are more affordable than ever. In the last decade alone, the cost of solar energy and lithium-ion batteries (used for energy storage) decreased by 85 percent.

However, to continue the development of renewables, there is an often-overlooked factor in the public discourse: critical minerals. The U.S. Energy Act of 2020 defines a “critical mineral” as a material or mineral essential to the economic or national security of the U.S. and which has a supply chain vulnerable to disruption. Many clean energy technologies such as solar panels and battery storage require a variety of these critical minerals, including copper, aluminum, cobalt, nickel, lithium, chromium, zinc, rare earth elements (REEs), and platinum group metals (PGMs).

According to the International Energy Agency (IEA), the average quantity of minerals needed for a new unit of power generation capacity has increased by 50 percent since 2010 due to the increase in use of renewable energy technologies. In the past, the energy sector was a small proportion of mineral demand. However, if we are to follow goals outlined in the 2015 Paris Agreement, mineral demand within the energy sector could increase over the next two decades to over 40 percent for copper and rare earth elements and 60 to 70 percent for nickel and cobalt. Lithium demand could increase to almost 90 percent.

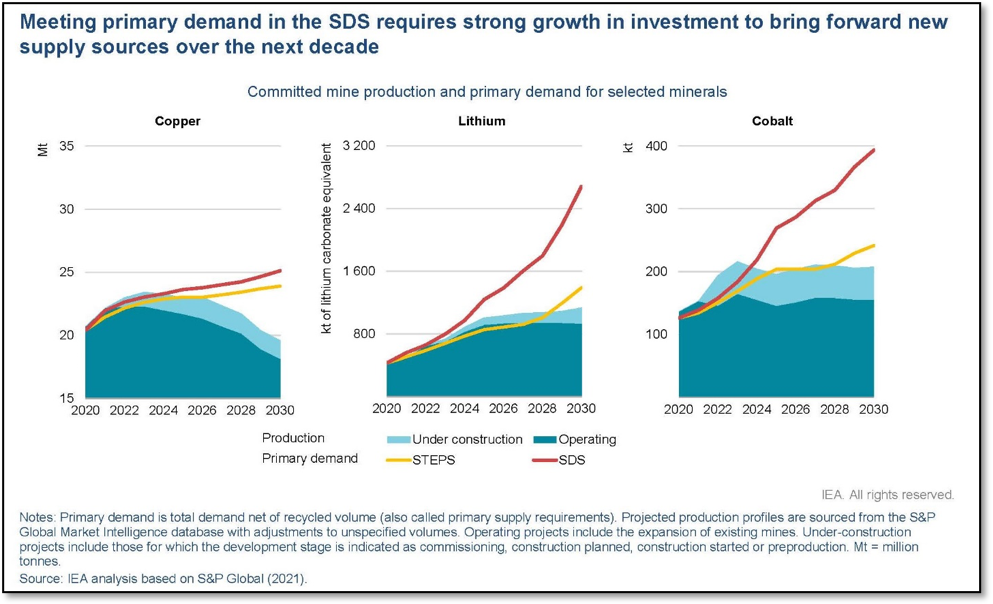

The IEA’s Sustainable Development Scenario (SDS) is one modeled future pathway to reduce carbon emissions. Meeting this goal could require four times the mineral levels for clean energy by 2040. If the goal is increased to “net-zero” globally by 2050, it would require a six-fold increase in mineral inputs by 2040, according to the IEA (2022). This projected demand is shown in the IEA’s graph below. Both of the main IEA future scenarios are shown, SDS as well as the more conservative STEPS or Stated Policies Scenario.

While this demand increases, there are serious concerns about whether supply can keep up. Specific concerns by IEA regarding supply of critical minerals include:

- Geographical concentration: Production is located in just a few countries including China, Democratic Republic of Congo, Indonesia, Australia and Chile.

- Long Project Lead Times: IEA’s analysis found that it takes on average 16.5 years to get critical mineral projects from discovery to initial production.

- Resource Quality: While economically recoverable reserves have been increasing over the years (with no signs of changing), the quality of these ores has actually been decreasing for some time.

- Environmental, Social and Governance (ESG): Many of the countries that are needed for critical minerals score very low in terms of ESG.

- Climate Risk Exposure: Among critical minerals, copper and lithium are particularly vulnerable to water stress. This is concerning given that over 50 percent of current lithium production is in areas of the globe with high water stress levels. Approximately 80 percent of copper in Chile is from mines in arid areas prone to high water stress.

These pressures will be felt in all renewable energy technologies. For example, the deployment of solar is expected to triple by 2040 based on IEA’s SDS. A large portion of that growth will be in China, India, and the U.S., as well as growing demand in emerging economies. Yet the use of critical minerals in solar panels varies widely with copper, silicon and silver being the most predominant. Improving solar technologies are expected to reduce the long-term demand for silicon and silver, but the need for copper in solar is expected to more than double by 2040 according to the IEA. It is important to note that the evolution of solar technology could go in several different directions, some of which will increase demand for yet other critical minerals like cadmium, tellurium and/or gallium.

Despite all of these challenges, it worthwhile to remember that humans are resourceful, and there is hope. For some perspective, Hannah Ritchie, Head of Research at Our World in Data, pointed out in a January 2023 article that we mine seven million tonnes of minerals for low-carbon technologies on a global basis every single year. This is far below the projected need of 28 million tonnes of minerals by the year 2040, based on the IEA’s SDS scenario. But Hannah points out that we currently produce 15 billion tonnes of coal, oil, and gas every year. So, with context, it is clear that the size of the problem is in some ways much smaller than the amounts of earth materials that we currently pull out of the ground every year.

How do we improve supply? One approach is to improve the “circular economy” of critical minerals (i.e., reduce, reuse, recycle, etc.), particularly for lithium batteries. Meanwhile, the United States Geological Survey has begun a study at Mountain Pass in California, the only existing U.S. mine for REEs, where preliminary data indicates there may be additional undiscovered deposits. Other possible sources, including coal ash, off-shore deposits, and geothermal brine, are all being examined. As we all have learned so much about “supply chains” over the last few years, the critical minerals supply chain is one that the United States (and the globe) will need to focus on with greater effort.